We sometimes write to you to let you know of upcoming planned maintenance work, repair visits and safety checks to keep your home in good repair and to keep you safe.

Some tenants have told us that disrepair claims management companies pretending to be Progress Housing Group or working on our behalf may write to you or cold call at your home.

These companies pretend to be us to gain access to your property or to pressure you to sign legal instructions that may cost you money.

It can be difficult to tell what a genuine letter from us is. The checklist below can help you tell if you receive a letter about a repair or a survey that is genuine.

Your checklist

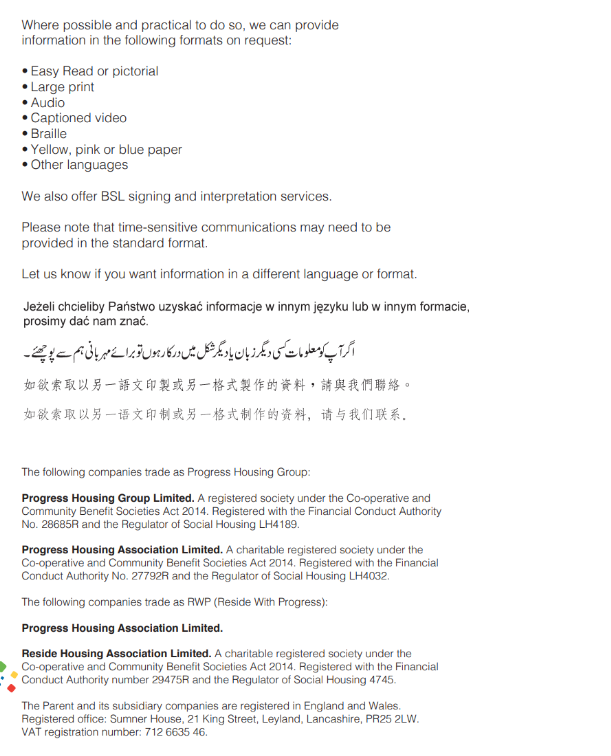

1. Is the letter printed on Progress Housing Group headed paper? It should look like this

2. Has someone working for Progress Housing Group signed off?

3. Does the letter have our registered office telephone number and address?

4. Does the letter have our official trading statements on the back?

5. Is there an option for you to request the letter in another format or language?

All our letters are printed with the information, as listed above. If you are still not sure, please get in touch with us on 0333 320 4555, and we will confirm if a letter is genuine. You can also contact us via live web chat on our website, (Monday to Friday, 8am-5pm).

Keep safe from scammers

- Always think twice before responding to a letter. If a company writes to you and ask for information you are not happy to provide, or they cannot validate who they are, do not supply them with the information.

- Be vigilant and always ask to see Progress Housing Group ID if anyone calls at your home. Don’t let anyone into your home if you are not sure.

- If a company writes to you who you have not dealt with before, question how they got your details.

- Contact Royal Mail if you've received scam mail and send it to them with a covering letter. Alternatively, you can send it to us or hand it in. If you are worried about bogus cold callers and online safety, we have more information.

- If you'd like more information about scams or would like to report a scam, contact Action Fraud.